Part 2 - Calculating Inflated Payouts in Variable Markets

- Cam Anderson

- Nov 29, 2022

- 6 min read

Updated: Dec 12, 2022

Payouts must vary with unpredictable investment results yet support donor intentions. How do future generations decide what exact dollar amounts to payout and re-invest?

This is part two of a two-part article on determining payouts in variable investment markets. In part one, we illustrate how to robustly accommodate a range of donor objectives and payout amounts to withstand history's wildest 25-year market gyrations.

Recall that in part one, in assessing the gyrations over a rolling history of growth rates, we recommended using a 25-year investment-payout cycle. Such a period coincides with significant anniversaries we traditionally celebrate and represents the approximate distance between generations.

This second article will present how best to calculate the payout amounts and the donor planning implications every 25 years. The complication is how to deal with inflation.

Calculating the payout

Payout after variable market returns depends on two main factors: 1) the donor's intention and 2) the actual investment results expressed as a multiple of the starting funds.

The donor's intention varies with the stage of the fund's growth. At the maximum gift level, investment funds carried over should equal the investment cycle starting level so that the gift is the bulk of the fund, the remainder.

If the donor wants the funds first to grow much larger in real dollar terms before entering the maximum gift stage, then the fund is in a growth stage, and the gift level is lower than, or at most equal to, the amount carried over for re-investment.

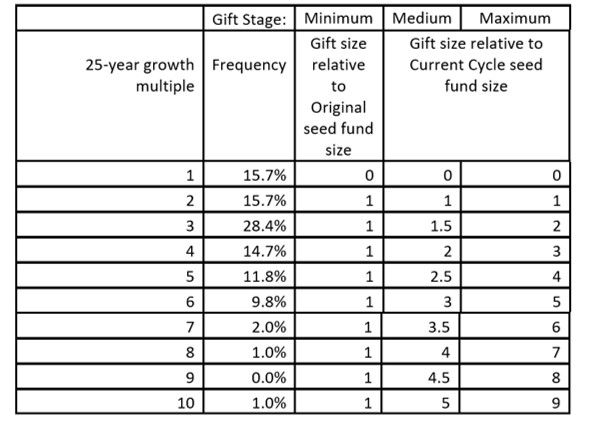

Once we know the donor intention, the choice of payout comes from Table 3 in part one, corresponding to the growth multiple achieved. Here is a copy of that table for reference:

Calculating the investment growth multiple

The actual investment results expressed as a multiple of the initial dollars is a simple calculation of the final dollar value divided by the initial dollar value.

For example, let's say $100 grew to $900 over 25 years. The growth multiple would appear to be 9.0 (i.e. $900 divided by $100). But this would be incorrect.

The complication is inflation. These values (the $100 and the $900) must simultaneously be expressed in either real dollar terms at the start or in future dollars at the end of the twenty-five-year investment period. Since payout decisions occur at the end of an investment cycle, restating the initial invested amount in future dollars is the most convenient view.

Inflation is measured by the Consumer Price Index (CPI), and annual statistics are readily available[i] for all the years we have used to analyze market variability.

For example, let's assume our 25-year period was from 1980 to 2004. Here are the CPI results over that period.

The inflation factor is calculated as (1 + CPI %) multiplied by the same for each of the period's 25 years. The resulting example equation using the above 1980 - 2004 statistics is:

(1+0.135)x(1+0.103)x(1+0.061)x …and so on ….x(1+0.023)x(1+0.027) = 2.600 or 260.00%

Using this 260.00% example conversion factor, we can now determine the true growth factor. In future dollars, the most convenient view, the answer requires restating the starting value in future dollars. This means multiplying the actual starting value of $100 by 260%, which equals $260, the starting value expressed in future dollars.

The future dollar value of the account we have is $900, so the net real growth multiplier is $900 divided by $260, which equals 3.4616[ii]

Our example payout

We now look up a growth multiple on the above Part 1 Table 3 of payout planning[iii] using our calculated multiple of 3.4616.

As 3.4616 is less than 4, we use the growth multiple 3 to determine the payout “Gift Multiplier." Part 1 Table 3 with a 25-year growth multiple of 3 recommends a gift size of "1" for Minimum Gift, "1.5" for Medium, and "2" for Maximum Gift. A theoretical maximum gift of "2.4616" has been added to reflect the actual example.

Implications for donors

Payout calculation varies with growth results, inflation, and donor intentions. Growth results and inflation statistics are publically available; donor intentions are not.

Donors, therefore, must be clear on their intention and offering organizations supporting this form of charity must carefully capture the intent. Donors must accept the offered payout plan or modify it according to their wishes. This payout plan forms an essential component of the donor contract with the investing organization.

When creating a plan, donors must stick to the basic principle that the value of investment funds re-invested into the next period must not be lower than the investment fund level at the start of the completed period. All donors' choices essentially are to declare how aggressively to give immediately or grow first to give more later.

Our guiding principle: Each cycle reinvests the equivalent dollar of the original starting fund. For example, we began the above illustration with $100 as the starting level. The future value of the $100 is $260. Our guiding principle would require beginning the next investment period with no less than $260 re-invested.

In the maximum gift scenario, the investment carryover could theoretically be as little as $260, or as shown in Table 2, maybe a little larger ($380). This larger recommendation is due to the gift of $520 (twice the seed fund) being less than the theoretically possible maximum of $640 (2.4616 times the seed fund). Differences in the maximum gift arise because we have grouped a range of results by each level of multiple. Using the theoretical maximum is fine, but using the recommended maximum will ensure slow growth over multiple cycles and buffer against future low market results.

In a minimum gift scenario, the investment amount carried over would actually be $900 less $260 = $640. Theoretically, a donor may ask that all $900 be carried over, which would indeed maximize growth, but this is not recommended. A better plan is to give something every 25 years to keep future generations engaged and supportive.

The transition from minimum to maximum gift giving can be specified by the donor at the inception of the payout plan. Donors can specify a maximum gift level in today's dollars and then specify the approach to reach that level, given the value of seed funds they contribute. Generally, donors would specify the plan via either time-driven or dollar-driven markers.

A time-based objective, for example, could state that the funds follow a minimum gift level for 50 years, a medium gift level for 75 years, and transition to the maximum gift level at year 125. This form of payout directive is clear and applies regardless of market performance.

A dollar-based objective, for example, could state that the funds follow a minimum gift level until, in real dollar terms, the fund is ten times larger and then follow a medium gift level until 100 times larger than the original contribution before transitioning to the maximum gift level. This form of a directive is based on market performance and requires future dollar calculations discounted for inflation. This plan is more complex and delivers impact magnification with roughly estimated timing.

Should a fund grow forever? While some donors may find that appealing, a further recommendation is for the fund to stop growth after 200 years. After 200 years, all funds should convert to a maximum payout. This 200-year level allows for significant fund growth but caps the wait time.

In conclusion

Donors must be clear on their intentions for the seed funds. Once plans are set, calculations can be easily performed.

This two-part article demonstrates a workable process to calculate the gift and re-investment amounts under the range of conditions that have been experienced to date and leads to the following:

Guiding Principle: The reinvested amount must be equal to or greater than the starting investment value, with both amounts being stated in equivalent dollars.

Outlier years may yet occur, but by sticking to the guiding principle, the donor can expect to achieve the predicted results over time.

***

[i] CPI data was taken from here Consumer Price Index, 1800- | Federal Reserve Bank of Minneapolis (minneapolisfed.org) [ii] The other way to calculate the growth multiplier is to divide the $900 by the inflation factor of 2.6 to arrive at $346.16 in initial dollar terms. That amount, $346.16 divided by $100, yields the same multiplier, 3.4616. [iii] See the 25-year growth multiple at level 3 on the third table in part one here.

Photo by Sean Robertson on Unsplash

Comments